Situating Stablecoins in the Payments Landscape

Analyzing the platypus of payments

Introduction

Stablecoins aren’t “room-temperature super conductors for finance,” as Patrick Collison has said. Room-temperature superconductors are theoretical, and people don’t have great intuitions about them. Stablecoins exist and work great today. They are more akin to “Starlink for finance”.

Stablecoins allow anyone on the planet with a smartphone and an internet connection to participate in a global payments network. Today, it’s a bit more “expensive” in many places to use stablecoins as compared with a local payments system (given frictions involved with going from local fiat to stablecoins via an exchange or an intermediary). But if you’re willing to stomach the upfront burden of getting onboarded to stables, you are suddenly an equal peer in a global network. In many countries where getting access to USD banking was impossible or limited only to the very affluent, this is a gamechanger. Just as Starlink brings billions of people online for the first time, stablecoins bring billions into the dollar economy for the first time. The economic impact of both technologies will be measured in the trillions. In fact, they will work in tandem. Billions of individuals will soon have the ability to become active participants in the modern online economy for the very first time, and they will be able to get paid efficiently, without relying on legacy infrastructure.

This explainer presupposes relatively little prior knowledge of stablecoins. The objective of the piece is to simply explain what stablecoins are, and how they differ from established payments solutions. This piece is targeted at:

Crypto-natives who are looking to learn a bit more about how stablecoins relate to payments

Payments folks who want to understand why there is so much excitement around stablecoins

Founders wondering what exactly it is that makes stablecoins special as a substrate

What are stablecoins, again?

Stablecoins are a tokenized representation of a fiat currency that circulate on a public blockchain. There are various backing and creation/redemption mechanisms that exist in the market. The most popular is simply to back the (typically dollar) claims with short-dated Treasurys (or other highly liquid assets like cash or reverse repos). This is your classic stablecoin – USDT, USDC and so on. Then you have overcollateralized crypto-backed stablecoins, like the original DAI. And then you have more complex systems like Ethena’s USDe which is sort of a tokenized basis trade. Some stablecoins pay interest; most don’t, and in the US they probably never will (directly). For the sake of this discussion I’m going to focus on the conventional, fiat-backed stablecoins, as they represent the vast majority of the market. And I’m also going to mostly talk about USD stablecoins since they are >99% of the market.

These stablecoins have the following qualities:

They can be held self-custodially. You can own a stablecoin “directly” in a blockchain wallet of your choice. Of course, what you own is ultimately a claim on the dollar reserves of the issuer, and generally, you can’t redeem directly. But you don’t need a direct relationship with an issuer to assume that they will generally trade at par. If the coin trades at a discount or premium (and the issuer has the reserves), sophisticated firms will arbitrage the peg and restore it to par. Users don’t have to do anything to make sure of this. They just have to have confidence that market mechanisms will play out. (For instance, if USDT trades well above par, issuers will create units of USDT with USD; if USDT trades below par, arbitrageurs redeem units of USDT for USD and pocket the difference, causing supply to shrink). Legislation requiring seniority in bankruptcy and high-quality, short-duration collateral, further enhances par assurance. For some non GENIUS-regulated stablecoins, it remains true that in many cases holders are effectively unsecured creditors of the issuers.

Payments are push and final. Push payments (we’ll dig into this in a bit) are those in which the payer is, you guessed it, pushing the funds to the payee’s account. This means that transactions settle immediately. The only small caveat is if the issuer decides to freeze funds on chain (which does occasionally happen), but the vast, vast majority of transactions settle without incident. Speed is a function of the blockchain but for all intents and purposes transactions are instant. Final means transactions are not reversible. This is like wires, and unlike, for instance, credit card payments.

Users have unfettered read/write access to the underlying database. Anyone not on the OFAC sanctions list can make a blockchain wallet and receive or send a stablecoin without asking for permission or doing any kind of “onboarding”. And you don’t have to ask any intermediary for permission to make a transaction. The only exception is cases of crime or fraud in which the issuer freezes the stablecoins in question (virtually all stablecoins have “freeze and seize” functions). This happens only occasionally, and stablecoin issuers have different policies here. But it is true that the blockchain is only an “indicative” ledger, and the “real” ledger is maintained by the stablecoin issuer.

Bearer in nature. With stablecoins, whoever controls the private keys controls the funds. Virtually every other system talked about in this article, aside from cash, relies on account identifiers.

They follow the permissioned pseudonymity model. This is a term coined by Antony Lewis describing the privacy model of stables. Issuers have a direct relationship with only a tiny percentage of stablecoin users – the entities creating and redeeming the coins. The remainder of the users, whether its firms or individuals transacting on the network, are pseudonymous, and so the issuer doesn’t have a clear sense of who they are or what the transactions are for. (This is actually very similar to how cash works. If you are “creating” or “redeeming” cash by, say, withdrawing or depositing a lot of cash from a bank, the bank knows who you are. But ordinary cash transactions are unsurveilled and unreported. This isn’t seen as unusual or bad in the case of cash.)

The issuer sometimes tries to find out who these users are by connecting real-world identity information (exposed at exchanges) to on-chain addresses, if they have been alerted to a hack or a theft. And it’s reasonable to believe that issuers have a general sense of who is using their network via on-chain analysis, because presumably the issuer and their regulators wouldn’t be very happy if the token was being overwhelmingly used for crime. But the current model of stablecoins is simply that the issuers are generally unaware of the identity of their users and there’s a relatively high cost to discover the details of a transaction. Importantly, this information is not proactively volunteered by the user. This is different from how virtually every other digital payment system works, whether it’s banking, a state-run network, or a fintech app.Developers can build on them with no permission. Generally speaking, software wallet developers building on stablecoins do not need to engage in the arduous process of getting money transmitter / e-money / bank licenses in order to facilitate transactions between users. This dramatically lowers the fixed cost involved in building a product that allows users to hold and send value, whether it’s a simple wallet, a fintech application, a stablecoin “neobank,” or a financial superapp. Importantly, this only holds when the app is meaningfully “noncustodial,” meaning that users control their coins through the software, rather than the developer holding everyone’s funds in an omnibus account and settling transactions on their behalf (which is how apps like Venmo work for instance). Today, there are ways to build an efficient and safe financial application based on stablecoins such that the developer has no control over user funds at any point in the flow (although not all stablecoin apps are built like this!). This is the real magic of stablecoins from a founder’s perspective. This reduces the fixed cost of building a neobank or fintech-style network from possibly hundreds of millions (if you are getting a bank charter) or tens of millions (if you are getting money transmitter licenses etc) to simply the engineering cost – possibly under a million dollars. As you might imagine, this order of magnitude reduction in fixed costs is causing an explosion of products in the space. (If you are a venture capitalist, those were the most important two sentences of the article.)

Blockchain infrastructure is non-hierarchical. Unlike any other transnational payment system, stablecoins exist on a “flat” architecture, where the largest and most powerful institutions are equal peers with the humblest retail user. In virtually every other major payment system, there is a rigid hierarchy enforced. For instance, fintechs like Venmo and PayPal involve a custodian that is processing the payments for you, and determining whether you are entitled to use their network. In banking, of course, governments enforce quasi oligopolies whereby users need to rely on their banks to process their wires and ACH payments. As anyone who has ever sent a wire knows, you cannot “access the wires database” directly. You have to plaintively ask your bank to send it for you. And if that wire is going cross border, they have to ask other banks and facilitators like SWIFT for permission.

There are further nested hierarchies. When wires go overseas, banks don’t process payments directly, they rely on correspondents, and transactions are routed not in a straight line but through major hubs like New York, London, Frankfurt/Paris, Hong Kong, or Tokyo. If you are sending a dollar wire from Tanzania to the Philippines or from Mexico to Indonesia, these will go through New York (for the simple reason that it’s more efficient to settle trades in a common currency, and because it’s inefficient to maintain correspondents with banks in every country worldwide). The US wields a great deal of soft power by controlling financial flows, as a result, a huge fraction of payments worldwide depend on the ultimate permission of the US government. In stablecoins, transactions are simply broadcast and posted to the blockchain. Of course, intermediaries like Coinbase or Binance exist, but it’s always possible to simply DIY it – writing to the ultimate database directly. The US government could and may wield a bit more influence over stablecoins by exerting influence of the issuers (who hold the underlying dollars), but for now, the network is much flatter than any other cross-border system.

Stablecoins are interoperable and programmable. Stablecoins are not captive to any database administered by a bank, government, private company, or consortium. They are also final in settlement (there is no chargeback risk). This means that contracts conditional on the settlement of other transactions can be built. In other words, they are truly interoperable. Developers also have the ability to write contracts to the underlying database directly without permission from the government (compare with how costly it is to obtain the right to build on core transactional databases), meaning that an ecosystem of smart contracts can freely emerge. There’s nothing stopping developers building on the API for a private payments network, but these are exposed to the whims of the underlying corporate issuer, so we seldom see smart contracts emerge in a non-blockchain context.

Based on these qualities, stablecoins are much more like banknotes/physical cash than virtually any other payments system. Cash is of course generally held self-custodially. The main difference is that cash is a liability of the central bank (in a kind of weird way, of course, since it’s not redeemable for anything), whereas stablecoins are liabilities of an issuer and redeemable (under certain conditions) for dollars.

Stablecoins are an answer to the question: if you invented cash in 2025 and wanted to make it digital, how would you do it? They’re the best answer we have, and that’s why they’re so popular.

Where do stablecoins sit in the payments landscape?

As established, stablecoins are a very odd creature within payments, since they are like a form of private cash that can teleport. Cash is afforded very special qualities that other payments systems lack; namely, cash transactions don’t have to be reported to anyone (with some exceptions), they are private, and final. That’s unique, compared to virtually all digital payment system. This is why we sometimes say “if cash was invented today, it would be illegal”.

It wasn’t always this way, but as payment systems became electronic, it simply became much easier to collect financial data on users and to use that for law enforcement, power projection, and so on. Governments couldn’t resist the temptation. This is why the financial surveillance state we all live under (BSA, Third Party Doctrine, PATRIOT Act) was built over the last 50 years as everything went online and cash usage declined. It wasn’t necessarily sinister, just a new technological modality.

Stablecoins are similar to cash, in that issuers follow the permissioned pseudonymity model, don’t proactively identify users (on the blockchain), and only seldom freeze or seize coins. (Freeze and seize versus ordinary financial KYC is the difference in degree between a cop requiring a warrant to search your home and having to go through TSA every time you travel.)

But they are also different from cash, in that there are no limits to the scale constraints with a stablecoin payment (sending $1m takes the same effort as sending $1), and they happen online and hence can settle anywhere on the planet instantly. This is why people often compare stablecoins to electronic payments networks like Visa or PayPal, but they couldn’t be more different. And it’s these differences that make stablecoins so interesting.

In an effort to correctly situate stablecoins in the payments landscape I’m going to divide payments a few different ways. The most fundamental distinction between payments networks is whether they are push or pull. The distinction between the two is simply whether the payer (push) or the payee (pull) initiates the transfer. Push is like sending an email, whereas pull is like telling someone they have permission to reach into your pocket and take money whenever it’s due.

Cash is a push payment; when you hand it over, it’s final. Credit card transactions are pull because the merchant “pulls” from your line of credit and settlement happens later. In push, the payer is safer (as they can’t be unexpectedly charged) whereas pull is safer for payees. Typical push transactions might be p2p, payroll, or remittance transactions. Typical pull transactions are subscriptions, bill payments, or merchant transactions.

The next fundamental distinction is whether payment systems are closed or open loop. Closed loop systems are single ecosystems like Venmo or Cash App. Typically one firm controls issuance, acceptance, and settlement. Gift cards and systems like M-Pesa are also closed loop. You can spend freely “inside the club” but not outside of it.

Open loop systems are multi-party networks where different issuers interoperate within a single scheme. This includes credit card schemes in which any issuer’s card works at any acquirer’s merchant, or interoperable bank-driven systems like ACH or Fedwire.

This doesn’t necessarily mean that closed loop systems can’t be widespread – cash, for instance, is a “pure” closed loop system but it is of course accepted universally in a given country and sometimes overseas too.

The last fundamental distinction is whether a payment network is government-administered, private, or a hybrid of the two. As we will see, many government-operated systems cluster around push + domestic. This is because many pull systems (like credit cards) create efficiency by taking on credit risk (and being willing to adjudicate these disputes). Governments don’t want to get involved in dispute resolution and want to minimize operational and legal complexity. Push systems are simple and easier to implement at scale.

Other distinctions between networks that I cover are domestic versus global focus, and consumer versus enterprise usage modes. These can be a little fuzzy so I’ve made best efforts here. Of course, many payment systems are used both by retail consumers and large institutions, but they generally gravitate towards smaller or larger payments. With these continuums established, let’s move on to the visual examples.

Stablecoins in a visual payments taxonomy

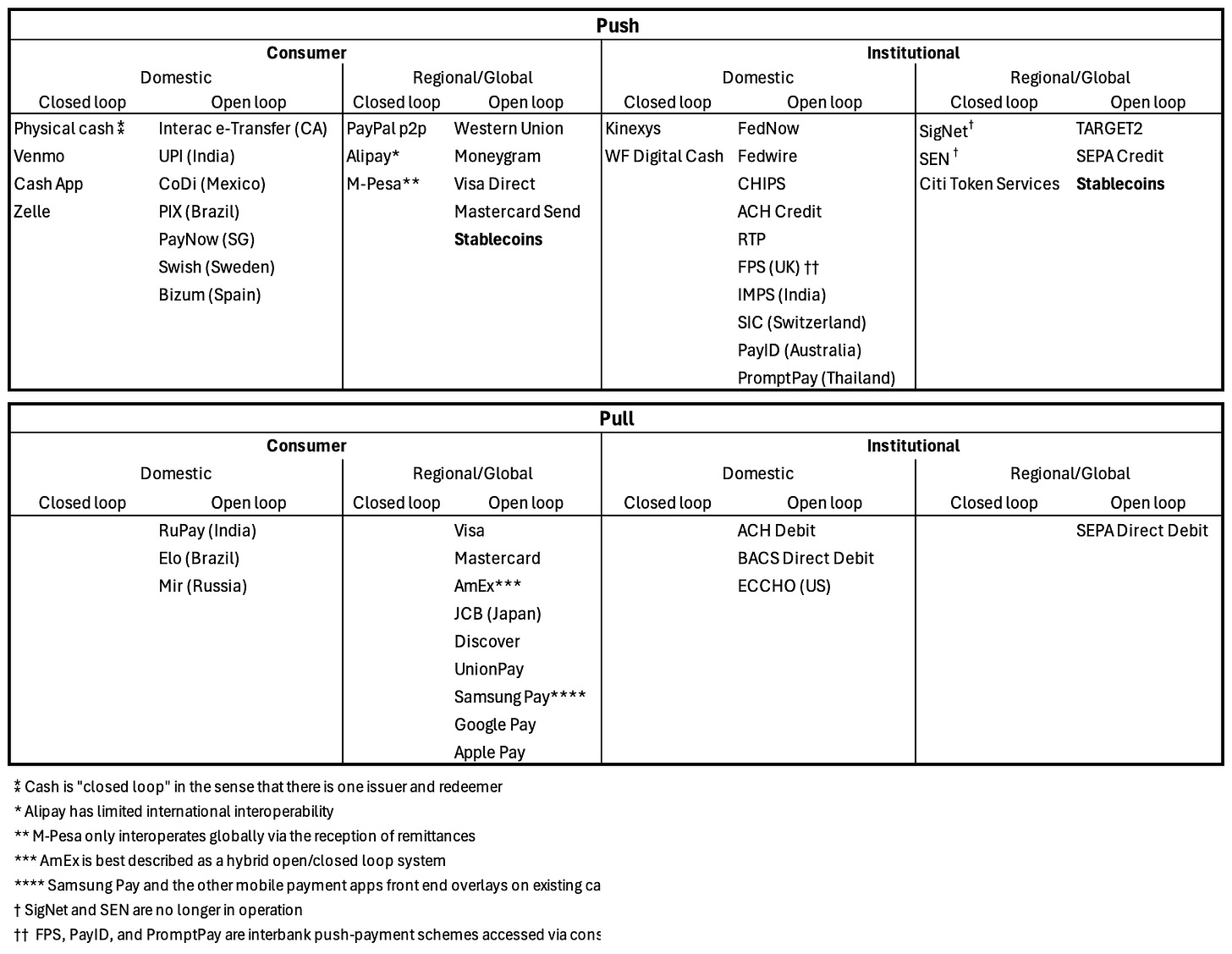

That’s enough preambling. This is my (nonexhaustive) master taxonomy of payments networks divided by push/pull, consumer/institutional, domestic/global, and closed/open loop.

According to this taxonomy, stablecoins are an open-loop, global, push payment system that are used both by retail consumers and large institutions. They are effectively unique in this regard.

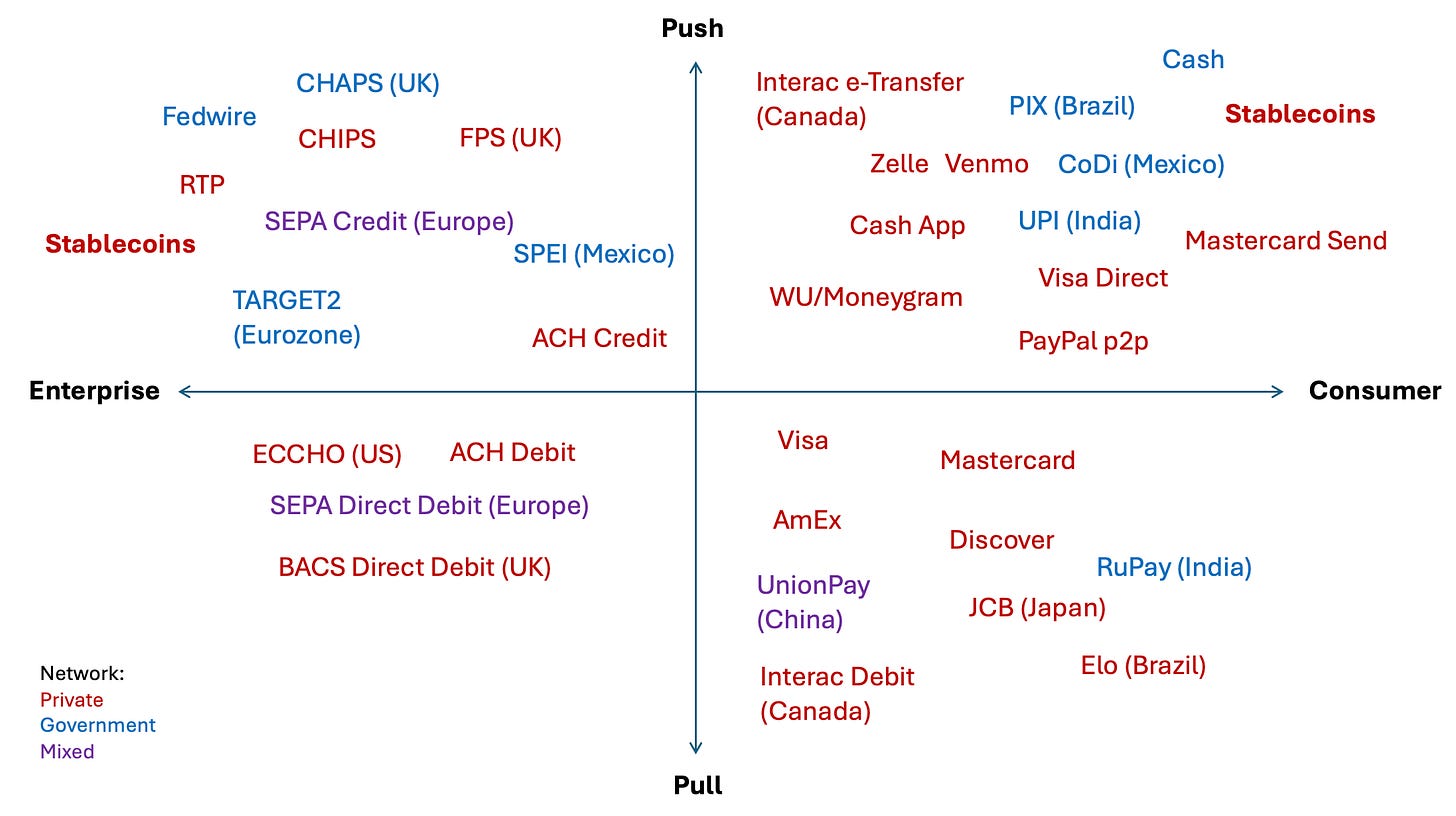

It’s a little hard to develop visual intuitions from the table, so let’s dig into a few variables at a time. Our first chart visualizes networks along the axes of push/pull, global/domestic/regional and private/government/mixed.

You can see that there are many government-run domestic push systems, like Mexico’s SPEI, Brazil’s PIX, or India’s UPI. In the US we don’t have anything equivalent to this at the retail level, aside from physical cash (arguably, RTP and FedNow are somewhat similar but they don’t have consumer interfaces). Naturally, systems with a regional or global focus tend to be privately administered rather than government-run.

You’ll notice that most of the systems in the pull quadrants are private rather than government-run. This is because a “pull” payment means that credit is being extended. Governments prefer base-layer, systemic infrastructure where neutrality and reliability matter. Private entities are better suited to building more complex pull systems because these involve chargeback mechanisms, reversals, and liability rules.

Stablecoins are push/global/private. Their nearest analogues on this chart are push systems like Visa Direct and Mastercard Send. Those are payment overlays “on top” of Visa’s and Mastercard’s networks which enable global fast settlement to debit cards and connected bank accounts.

Legacy remitters like Western Union and MoneyGram are also situated close to stablecoins on the chart. They are global in nature and offer cash payouts in underserved regions (reaching deeper than Visa or Mastercard). They are however more costly, reliant on legacy infrastructure, and fairly expensive. They are also mainly non-digital, cash-to-cash networks. Newer fintechs like Wise that work by prefunding bank accounts on both sides of the transaction also belong in this quadrant. Of course, these quadrant competitors are easily distinguished from stablecoins along the axes of interoperability, permissionlessness, and their direct dependence on banking infrastructure.

Our next two by two matrix covers push/pull and consumer/enterprise.

Most of these systems are explicitly built for a specific cohort of users. For instance, no ordinary person would ever have had direct experience of using Fedwire or ACH because those are managed by the banks. The various fintech and government administered p2p apps are targeted at retail users, as are credit card systems. Mexico has SPEI for more enterprise use cases and CoDi for retail.

Stablecoins are interesting here because their flat hierarchy means that retail and the enterprise can coexist on the same system. In practice, we see stablecoins being used for both large-value transactions like bank wires as well as for smaller-scale p2p transactions (although, if you look at the data, average stablecoin transactions skew larger).

This depiction helps elucidate why so many people compare stablecoins to retail p2p networks like Zelle, Venmo, or Cash App, because they “feel” similar. However, as the first chart shows, and as many Americans might not be aware, these systems do not scale globally, and they probably never will.

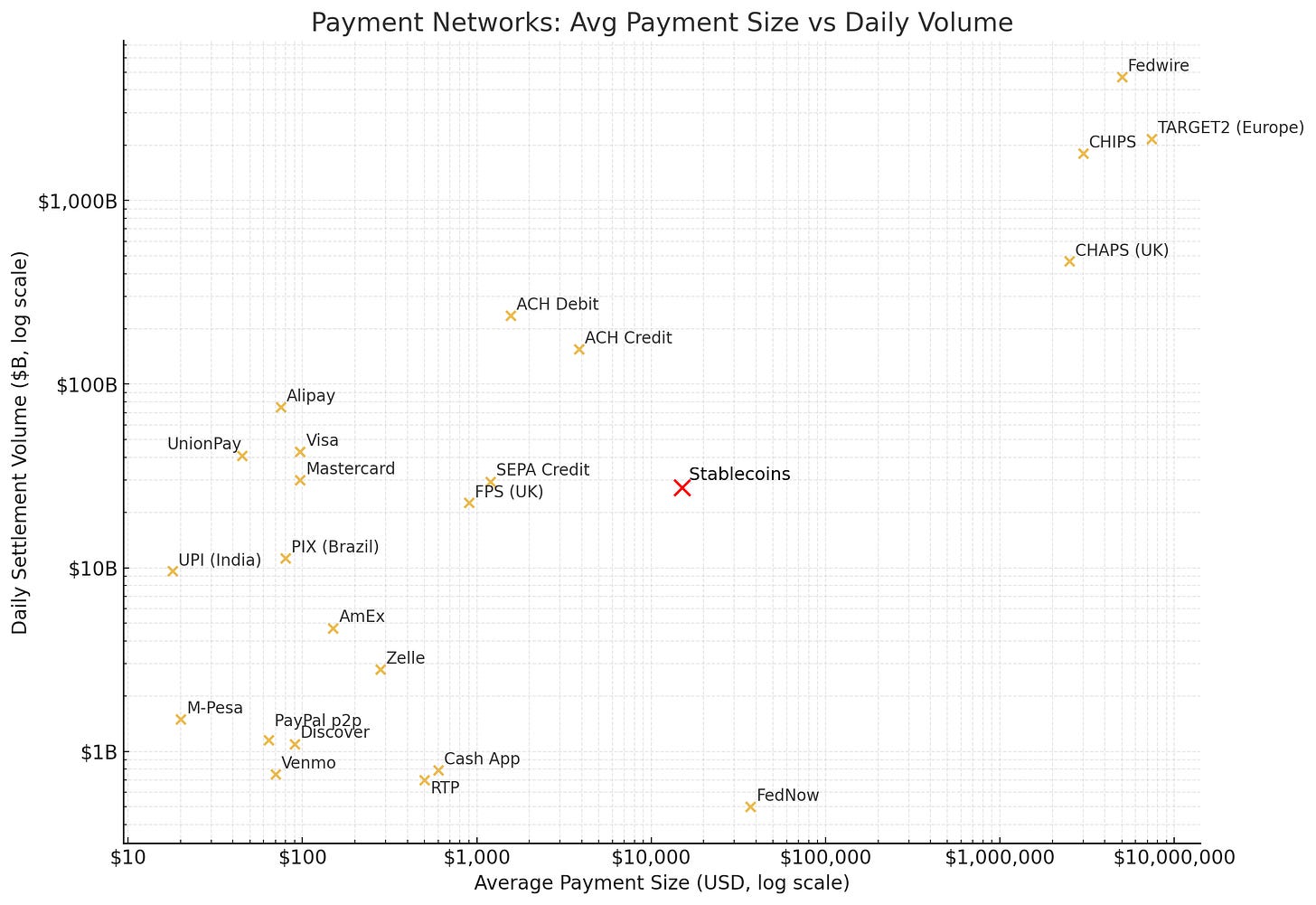

I made an effort to collect data on average payment sizes and daily payments volume on these networks wherever possible, to further tease out the retail versus institutional distinction.

Both axes are on a log scale because the chart depicts payment systems with average transaction sizes between $18 (UPI) and $7.4m (Fedwire). You can see clusters of small-value, peer-to-peer systems on the bottom left, larger credit card payment systems above them, enterprise payment systems like ACH in the middle, and then on the top right massive wholesale settlement systems like Fedwire or CHIPS.

Stablecoins are a little bit in the middle since they have heterogeneous uses including exchange settlement, large-value DeFi transactions, corporate cash management, and then of course peer to peer transfers. Many retail stablecoin transactions happen through intermediaries such as Binance Pay, which don’t strictly hit the blockchain every time. (You can see more of this stablecoin data in our recent report on stablecoin payments). At their terminal state, I expect stablecoins to eventually join the “upper right” club on this chart and settle trillions of dollars of value a day as opposed to their current rate of around $25b daily.

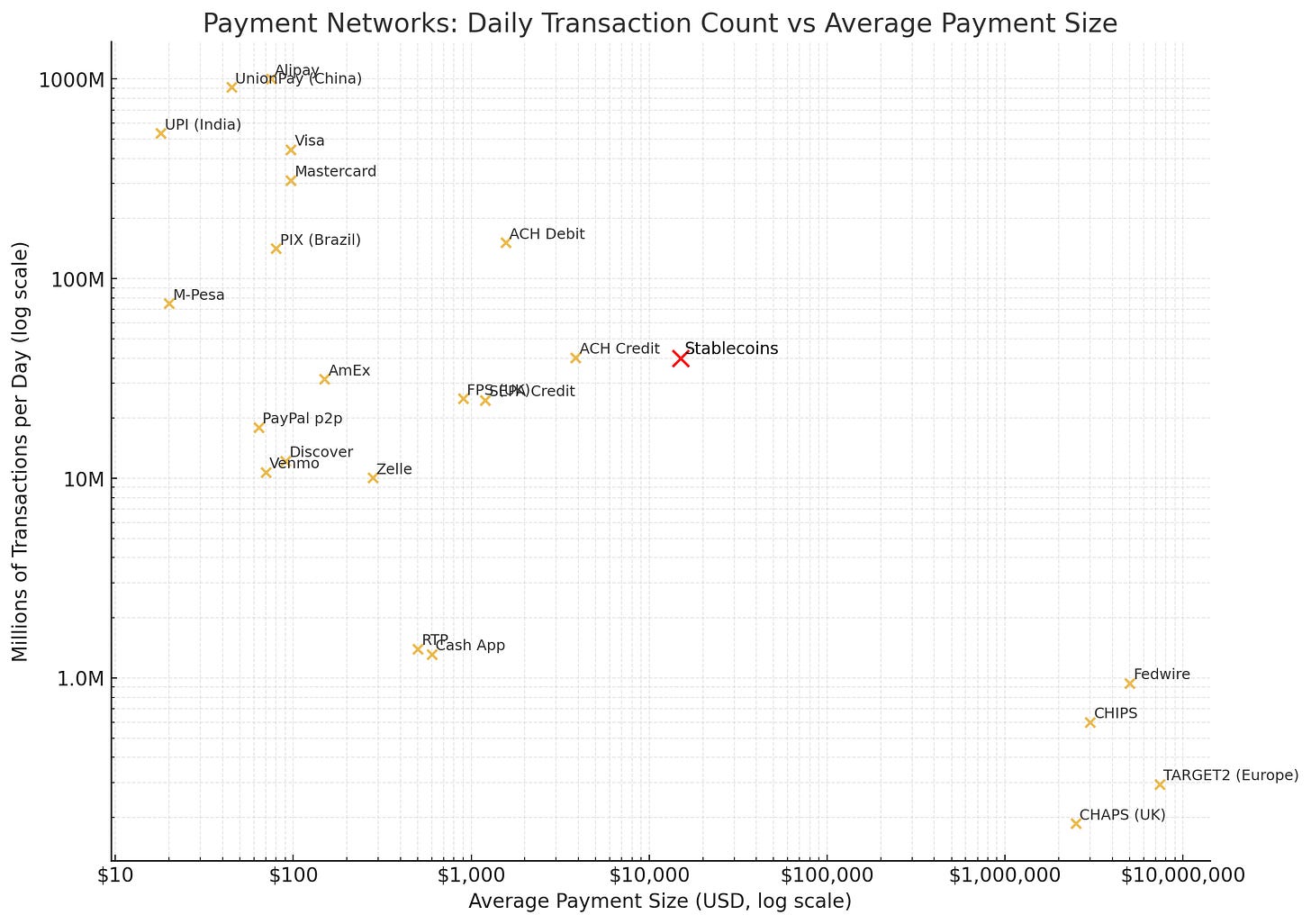

You can see a negative association, as you would expect, between transaction count and average transaction sizes when you plot these systems out.

Stablecoins are again a little bit on their own, as they settle around 40 million transactions a day on all blockchains (according to Artemis) and have mid five figure average transaction sizes. I expect them to keep moving upwards on this chart as they continue to scale to hundreds of millions of transactions per day. In this respect, they continue to defy categorization, because they are reaching significant scale in terms of value settled, but are also very capacious from a transaction count perspective. Again, this is due to the fact that both large institutions and ordinary retail users share a single network, so you have something that behaves like a small-value, high frequency p2p app, while also being secure and credible enough to settle multi-billion dollar transfers.

So what are stablecoins, again (again)?

Hopefully this helps elucidate how stablecoins relate to other payments networks. This taxonomy gives us helpful ways to reason about them. For instance:

What if you could teleport cash anywhere on Earth?

What if you could reach into your bank’s database and directly register the bank wire transaction?

What if you could scale up Cash App to a global audience of users, and the issuer couldn’t kick anyone off the network?

What if you could make a credit card transaction in the US conditional on the settlement of a wire transfer in Japan?

None of these analogies are perfect. From a privacy and autonomy perspective, they are like cash, since they settle instantly and you don’t have to tell anyone about your transaction. But they are also unlike cash in that there are no constraints to scale, whereas handing someone a billion dollars in cash is impractical. Cash doesn’t teleport, and it’s also not freezable at a distance like stablecoins are.

Stablecoins offer the international cross-border finality of wire transfers, but they are far more convenient, not intermediated by banks, and settle in the 76% of hours of the week when banks are closed.

Based on this table, stablecoins are “most like”:

Visa Direct / Mastercard Send: global push networks overlaid on top of banking infrastructure

BUT: settlement still runs through card networks and banks

Western Union / MoneyGram: consumer-to-consumer cross-border cash payout networks

BUT: these are centralized operators relying on agent networks and cash payout

Interbank push systems like Faster Payments (UK), PayID (Australia), PromptPay (Thailand): 24/7/365 interbank push systems offering instant settlement with consumer interfaces.

BUT: settlement is final because these are domestic, central-bank linked systems. They are account-based and non-programmable

You can continue this exercise ad nauseam; stablecoins simply don’t map well to any existing payment network. They are the platypus of payments. And this is because stablecoins emerged in order to fill a void that existed in payments: a digitally-native cash system. This is also why payments people and central bankers are sometimes horrified by stablecoins: because they violate their intuitions about how a properly-designed payment system should work. They are interoperable and programmable in a way that virtually no payment system is; they collect less data on their users than governments would like; they trade safety for convenience (the bearer-approach that makes stablecoins so useful also exposes users to the risk of key loss); and there is no easy mechanism to prevent criminals from using the network.

Stablecoins are different because they are a rebellion against the status quo in payments. Where payments systems are overbearing, sclerotic, overly rigid, expensive, or simply don’t serve users well, stablecoins fill the gap.

Well done. I agree on everything excluding: "This is why the financial surveillance state we all live under (BSA, Third Party Doctrine, PATRIOT Act) was built over the last 50 years as everything went online and cash usage declined. It wasn’t necessarily sinister, just a new technological modality"

Reporting thresholds have never/will never be adjusted for inflation, which increases the number of entities and individuals captured by regulatory requirements over time.

Not adjusting thresholds results in “bracket creep,” where more people or entities fall under regulatory mandates as inflation erodes the real value of the threshold, effectively expanding the regulatory net without legislators having to actively change laws or face the political fallout of explicit regulatory expansion which many could find: sinister.

It's not quite clear to me yet which and whether all Stablecoins are cash/cash equivalents on the accounting side. Reading the fine print on some of them, it seems they follow different areas of GAAP. I don't fault the author of the article for omitting this discussion. The accounting classification issue will be settled eventually. However, the accounting terminology is upstream of this whole debate. Is it worth lingering a second and to consider bank run scenarios? Tether FUD has died down, but are we willing to equate Stablecoins with treasuries just yet, even for trusted players like Circle? caveat empor† and as those who were around 2007/8 remember, everything that's packaged & bundled stinks. -F